Capital finance is a valuable tool for businesses to unlock the potential of their funds. Whether you need to expand your operations or boost your cash flow, capital finance can provide the funding necessary to achieve your goals. Working capital finance is a subset of capital finance that helps businesses manage their day-to-day expenses and keep their operations running smoothly.

There are several different funding solutions available for businesses looking to access capital finance. Some of the most common options include bank loans, lines of credit, and factoring. Each option has its own advantages and disadvantages, so it’s important to carefully evaluate your options before making a decision.

Banks are a popular source of capital finance for businesses. However, banks are often very risk-averse and may require extensive documentation and collateral to secure a loan. This can make it difficult for smaller businesses or those with less established credit histories to access this type of funding.

Lines of credit are another option for businesses. These are revolving credit accounts that businesses can draw on as needed. The advantage of lines of credit is that they can provide a quick source of funding when businesses need it most. However, lines of credit often come with high interest rates and fees, so they can be expensive if not managed carefully.

Factoring is a financing option that allows businesses to access the value of their outstanding invoices before they are paid by their customers. This can provide a quick source of funding without the need for collateral or extensive documentation. However, factoring can also be expensive and may not be suitable for all businesses.

Regardless of which type of capital finance you choose, there are a few key factors to keep in mind. First, it’s important to have a clear plan for how you will use the funds. This will help you make the most of your investment and ensure that you are able to repay any loans or lines of credit on time.

Second, it’s important to choose a funding solution that fits your business’s unique needs and financial situation. This may require some research and comparison shopping to find the best option for you.

Finally, it’s important to work closely with your lender or financing provider to ensure that you have a good understanding of the terms and conditions of your funding agreement. This can help you avoid any surprises down the road and ensure that you are able to meet your obligations on time.

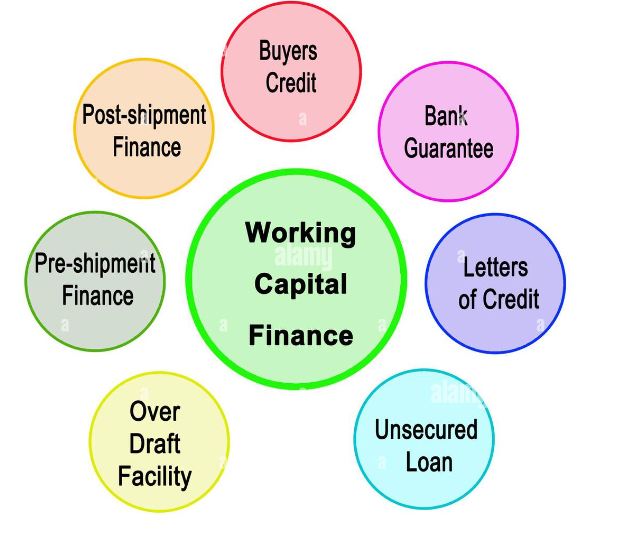

Working capital finance is a subset of capital finance that focuses specifically on providing funding for businesses’ day-to-day expenses. This can include things like inventory, payroll, and other operational costs.

There are several different types of working capital finance available, including lines of credit, term loans, and invoice financing. Each type of financing has its own advantages and disadvantages, so it’s important to carefully evaluate your options before making a decision.

Lines of credit are a popular form of working capital finance because they provide businesses with ongoing access to funds as needed. This can help businesses maintain their cash flow and meet their expenses on a regular basis. However, lines of credit often come with high interest rates and fees, so they can be expensive if not managed carefully.

Term loans are another option for businesses looking to access working capital finance. These are typically short-term loans that are repaid over a period of several months or years. Term loans can be a good option for businesses that need a larger amount of funding up front, but they may not be suitable for businesses with fluctuating revenue streams.

Invoice financing is a type of working capital finance that allows businesses to access the value of their outstanding invoices before they are paid by their customers. This can provide a quick source of funding without the need for collateral or extensive documentation. However, invoice financing can be expensive and may not be suitable for all businesses.

Regardless of which type of working capital finance you choose, it’s important to have a clear plan for how you will use the funds. This will help you make the most of your investment and ensure that you are able to repay any loans or lines of credit on time.

It’s also important to choose a funding solution that fits your business’s unique needs and financial situation. This may require some research and comparison shopping to find the best option for you.

Finally, it’s important to work closely with your lender or financing provider to ensure that you have a good understanding of the terms and conditions of your funding agreement. This can help you avoid any surprises down the road and ensure that you are able to meet your obligations on time.

In conclusion, capital finance can be a powerful tool for businesses looking to unlock the potential of their funds. Whether you need to expand your operations or boost your cash flow, there are several different funding solutions available to help you achieve your goals.

Working capital finance is a subset of capital finance that focuses specifically on providing funding for businesses’ day-to-day expenses. This can include things like inventory, payroll, and other operational costs.

Regardless of which type of capital finance or working capital finance you choose, it’s important to have a clear plan for how you will use the funds and to choose a funding solution that fits your business’s unique needs and financial situation.

By working closely with your lender or financing provider, you can ensure that you have a good understanding of the terms and conditions of your funding agreement and avoid any surprises down the road.

Overall, capital finance and working capital finance are valuable tools for businesses of all sizes and can help unlock the true potential of your business.